Use these links to rapidly review the documentTABLE OF CONTENTS

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| Preliminary Proxy Statement | ||

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to §240.14a-12 |

Burlington Northern Santa Fe Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| No fee | ||||

| Fee computed on table below per Exchange Act Rules 14a-6(i) |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NOTICE OF 20022003 ANNUAL MEETING OF SHAREHOLDERS

BURLINGTON NORTHERN SANTA FE CORPORATION

The seventheighth annual meeting of shareholders of Burlington Northern Santa Fe Corporation ("BNSF"(“BNSF” or the "Company"“Company”) will be held at 2:00 p.m. on Wednesday, April 17, 2002,16, 2003, at The Fort Worth Club, Horizon Room, 306 West 7th Street, Fort Worth, Texas for the following purposes:

| (1) | to elect 12 directors; and |

| (2) | to transact such other business as is properly brought before the meeting and at any adjournment or postponement of the meeting. |

Shareholders of record at the close of business on February 28, 2002,2003, are entitled to notice of the meeting and are entitled to vote at the meeting in person or by proxy. A list of these shareholders will be kept at the offices of the Company in Fort Worth, Texas, for a period of ten days prior to the meeting. Only shareholders or their proxy holders may attend the meeting.

By order of the Board of Directors.

Jeffrey R. Moreland

Executive Vice President Law & Government

Affairs and Secretary

2650 Lou Menk Drive

Fort Worth, Texas 76131-2830

March 11, 2003

YOUR VOTE IS IMPORTANT. Please mark, sign,vote promptly by toll-free telephone or via the Internet, or by signing, dating and datereturning your proxy card and return it promptly in the enclosedprepaid envelope, or vote by toll-free telephone as explained on theyour proxy card, whether or not you

plan to attend the meeting.

PAGE | ||||||

NOTICE OF | ||||||

1 | ||||||

1 | ||||||

1 | ||||||

1 | ||||||

1 | ||||||

1 | ||||||

2 | ||||||

2 | ||||||

2 | ||||||

3 | ||||||

3 | ||||||

3 | ||||||

3 | ||||||

4 | ||||||

5 | ||||||

5 | ||||||

5 | ||||||

5 | ||||||

5 | ||||||

6 | ||||||

6 | ||||||

7 | ||||||

8 | ||||||

9 | ||||||

9 | ||||||

11 | ||||||

13 | ||||||

13 | ||||||

13 | ||||||

| |||

COMPENSATION AND DEVELOPMENT COMMITTEE REPORT ON | 16 | ||

23 | |||

24 | |||

24 | |||

25 | |||

| 26 | ||

27 | |||

28 | |||

30 | |||

31 | |||

Independent Public Accountant | 31 | ||

31 | |||

32 | |||

33 | |||

33 | |||

34 | |||

Burlington Northern Santa Fe Corporation 2650 Lou Menk Drive Fort Worth, Texas 76131-2830 |

|

PROXY STATEMENT FOR 20022003 ANNUAL MEETING OF SHAREHOLDERS

Your vote is very important. For this reason, the Board of Directors is requesting that you allow your common stock to be represented at the 20022003 annual meeting of shareholders by the proxies named on the enclosed proxy card. We are first mailing this proxy statement and the form of proxy in connection with this request on or about March 11, 2002.2003.

INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

April 2:00 p.m., Central Time | The Fort Worth Club Horizon Room 306 West Fort Worth, Texas |

You will be voting on the following matters: | ||||

Who May Vote | You are entitled to vote your common stock if our records show that you held your shares as of the close of business on the record date, February 28, | |||

You may vote in person at the meeting or by proxy. We recommend you vote by proxy even if you plan to attend the meeting. You can always change your vote at the meeting. | ||||

Proxy Card: If you sign, date and return your signed proxy card before the annual meeting, we will vote your shares as you | |||||

1

| direct. | ||||

If you return your signed proxy card but do not specify how you want to vote your shares, we will vote your shares: | ||||

Telephone Voting: If you elect to vote your proxy by telephone as described in the telephone voting instructions on the proxy card, we will vote your shares as you direct. Your telephone vote authorizes the named proxies to vote your shares in the same manner as if you had marked, signed and returned your proxy card, as described above. | |||||

|

You can revoke your proxy at any time before it is voted at the annual meeting by: | ||||

Votes Required | The nominees for election as directors at the annual meeting will be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote. The 12 nominees having the greatest number of votes will be elected. | |||

2

shares present or represented by proxy and entitled to vote at the annual meeting. | ||||

| ||||

A broker | ||||

Effect of Abstentions and Broker Non-Votes. Abstentions have the same effect as negative votes. Broker non-votes and shares as to which proxy authority has been withheld with respect to any matter are not entitled to vote for purposes of determining whether shareholder approval of that matter has been obtained, and therefore will have no effect on the outcome of the vote on any such matter. | |||||

Inspectors of Election. Representatives of EquiServe Trust Company, N.A., will tabulate the votes and act as inspectors of election. | |||||

Shares held for the account of persons participating in the | ||||

For employees participating in one of the | ||||

3

If you plan on attending the meeting, please mark the appropriate box on your proxy card or, if voting by telephone or via the Internet, please indicate your plans when prompted. An admission card is included if you are a registered shareholder; simply detach it from the proxy card and bring it with you. If you are a beneficial owner of stock held by a bank, broker or investment plan (with your stock held in | ||||

We will pay our costs of soliciting proxies. | ||||

In addition to this mailing, the | ||||

The extent to which these proxy soliciting efforts will be necessary depends entirely upon how promptly proxies are submitted. We encourage you to send in your proxy without delay. We also reimburse brokers and other nominees for their expenses in sending these materials to you and getting your voting instructions. | ||||

We can provide reasonable assistance to help you participate in the meeting if you tell us about your disability and your plans to attend. Please call or write our Secretary at least two weeks before the meeting. | ||||

4

Pursuant to the Delaware General Corporation Law, the business, property and affairs of the Company are managed under the direction of the Board of Directors. The Board has responsibility for establishing broad corporate policies and for the overall performance and direction of the Company, but is not involved in day-to-day operations. Members of the Board keep informed of the The Company currently has In The Board has established Executive, Compensation and Development, Directors and Corporate Governance, and Audit Committees. No member of any committee is presently an employee of the Company or its subsidiaries with the exception of Mr. The The TheCompany'sCompany’s business by participating in Board and committee meetings, by reviewing analyses and reports sent to them regularly, and through discussions with the Chairman, President, and Chief Executive Officer and other officers.1413 directors. Each director is elected to a one-year term. TwoOne current directors—Robert D. Krebs and Arnold R. Weber—aredirector—Bill M. Lindig—is not standing for re-election at the 20022003 annual meeting, and the size of the Board is being reduced accordingly to 12.12 members.2001,2002, the Board met six times. Each incumbent member of the Board with the exception of Mr. Boeckmann who missed one committee meeting, attended 75 percent or more of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which he or she served. Average attendance at Board and committee meetings for all directors was over 9796 percent.Krebs,Rose, who serves as Chairman of the Executive Committee.TheExecutive Committee did not meet during 2001.2002. The committee can exercise the authority of the Board during intervals between meetings of the Board subject to certain limitations of Delaware law.TheCompensation and Development Committee met sevenfive times during 2001.2002. The committee is responsible for grants of stock awards, and reviews and makes recommendations to the Board concerning:•the compensation of the Chairman, and of the President and Chief Executive Officer and senior officers of the Company;•proposed employee benefit and stock plans, and Company compensation systems and practices; and5the compensation of the Chairman, President and Chief Executive Officer and senior officers of the Company;employee benefit and stock plans, and Company compensation systems and practices; andthe evaluation of the performance of the Company’s officers and the selection of individuals for appointment or promotion as officers.•the evaluation of the performance of the Company's officers and the selection of individuals for appointment or promotion as officers.TheDirectors and Corporate Governance Committee met twicethree times during 2001.2002. The committee reviews and makes recommendations to the Board concerning:the size and composition of the Board;nominees for election as directors;

The | ||||

Burlington Northern Santa Fe | ||||

6

for benefits. The annual benefit is the amount of the annual retainer fee for services as a Board member at the time of termination of service; the benefit ceases upon an | ||||

Burlington Northern Santa Fe Non-Employee | |||||

automatically be granted non-qualified stock options to purchase 3,000 shares of Company common stock (subject to adjustment as provided in the Non-Employee |

Beginning in April 2001, each | ||||

7

Restricted Stock Units will vest upon the date the director’s term of | ||||

The Non-Employee | ||||

Burlington Northern Santa Fe Deferred Compensation Plan for Directors. Non-employee directors may voluntarily defer a portion or all of the fees they would otherwise receive into a Prime Rate interest account, a Company phantom stock account, or other investment option established under the | |||||

Under the | ||||

Director Racicot is a partner with Bracewell & Patterson, L.L.P., which firm provided legal services to the Company in | ||||

8

expected to provide similar services in | ||||

9

STOCK OWNERSHIP IN THE COMPANY

To the best of the |

Name and Address of Beneficial Owner | Shares Held and Nature of Beneficial Ownership | Percentage | |||||

|---|---|---|---|---|---|---|---|

| FMR Corp. Edward C. Johnson 3d Abigail P. Johnson 82 Devonshire Street Boston, MA 02109 | 30,705,986 | (1) | 7.941 | %(1) | |||

AXA Financial, Inc 1290 Avenue of the Americas New York, NY 10104 | 27,243,295 | (2) | 7.0 | %(2) |

Name and Address of Beneficial Owner | Shares Held and Nature of Beneficial Ownership | Percentage | ||||

AXA Financial, Inc. 1290 Avenue of the Americas New York, NY 10104 | 29,095,983 | (1) | 7.7 | % (1) | ||

Barclays Global Investors, NA 45 Fremont Street San Francisco, CA 94105 | 20,434,183 | (2) | 5.41 | % (2) |

10

| (1) | Based on share holdings reported in an amendment to a joint filing on Schedule 13G dated February 12, 2003, reporting holdings as of December 31, 2002. The filing group includes: AXA Financial, Inc.; four French mutual insurance companies, AXA Conseil Vie Assurance Mutuelle, AXA Assurances I.A.R.D. Mutuelle, and AXA Assurances Vie Mutuelle, 370, rue Saint Honore, 75001 Paris, France, and AXA Courtage Assurance Mutuelle, 26, rue Louis le Grand, 75002 Paris, France, as a group; AXA, 25, avenue Matignon, 75008 Paris, France; and their subsidiaries. The Schedule 13G indicates that the reporting persons had sole voting power for 12,811,091 shares and shared voting power for 5,370,469 shares, and had sole dispositive power for 29,035,683 shares, and shared dispositive power for 60,300 shares. According to the Schedule 13G, a majority of the shares reported are held by unaffiliated third-party client accounts managed by Alliance Capital Management L.P., as investment adviser, which is a majority-owned subsidiary of AXA Financial, Inc. |

| (2) | Based on share holdings reported in Schedule 13G, dated February 10, 2003, reporting holdings as of December 31, 2002 by Barclays Global Investors, NA, Barclays Global Fund Advisors, Barclays Global Investors, Ltd., Barclays Trust and Banking Company (Japan) Limited, Barclays Life Assurance Company Limited, Barclays Bank PLC, Barclays Capital Securities Limited, and Barclays Capital Investments. The Schedule 13G indicates that the reporting persons had sole power to vote or direct the vote for 20,412,511 shares, and had sole power to dispose or to direct the disposition of 20,412,511 shares. |

Transactions with the Company. In June 2002, Barclays Capital Inc. (an affiliate of Barclays Global Investors, NA) acted as co-managing underwriter of an offering of $118,293,000 principal amount of pass through certificates (of which it underwrote $23,658,000) issued under a leveraged lease in which the Company’s wholly-owned subsidiary, The Burlington Northern and Santa Fe |

Railway Company (“BNSF Railway”), is the lessee. BNSF Railway paid Barclays Capital Inc. approximately $90,000 in underwriting fees. |

Barclays Bank PLC has agreed to provide up to $45 million in revolving credit loans to the Company under a 364-day Revolving Credit Agreement dated as of June 19, 2002. No loans were outstanding in 2002 and no loans are currently outstanding under this commitment. The Company paid Barclays Bank PLC approximately $45,000 in fees in 2002 related to this commitment. |

BNSF Railway and Barclays Bank PLC have entered into costless collar agreements utilizing West Texas Intermediate crude oil (WTI) and NYMEX #2 heating oil (HO). Between January 1, 2002 and February 28, 2003, BNSF Railway entered into collars covering 25.2 million gallons of HO expiring in 2003, and 7.1 million barrels of WTI expiring in 2003 through 2005, with an aggregate fair value (as calculated by Barclays Bank PLC) of approximately $24 million at February 28, 2003. |

The following table shows, as of February 28, |

| Name of Beneficial Owner | Position | Shares Held And Nature of Beneficial Ownership | |||

|---|---|---|---|---|---|

| Alan L. Boeckmann | Director | 0 | |||

John J. Burns, Jr. | Director | 27,809 | (1)(2) | ||

Robert D. Krebs | Chairman of the Board of Directors | 2,288,454 | (3) | ||

Bill M. Lindig | Director | 26,009 | (1) | ||

Vilma S. Martinez | Director | 18,412 | (1)(4) | ||

Marc F. Racicot | Director | 0 | |||

Roy S. Roberts | Director | 26,270 | (1) | ||

Matthew K. Rose | President and Chief Executive Officer, Director | 1,014,178 | (5) | ||

Marc J. Shapiro | Director | 27,776 | (1) | ||

Arnold R. Weber | Director | 39,185 | (1) | ||

Robert H. West | Director | 25,346 | (1) | ||

J. Steven Whisler | Director | 29,009 | (1)(6) | ||

Edward E. Whitacre, Jr. | Director | 39,389 | (1) | ||

Michael B. Yanney | Director | 32,722 | (1) | ||

Charles L. Schultz | Executive Vice President and Chief Marketing Officer | 766,876 | (5)(7) | ||

Carl R. Ice | Executive Vice President and Chief Operations Officer | 383,317 | (5) | ||

Thomas N. Hund | Executive Vice President and Chief Financial Officer | 634,432 | (5) | ||

Jeffrey R. Moreland | Executive Vice President Law & Governmental Affairs and Secretary | 732,567 | (5) | ||

Directors and Executive Officers as a Group | 6,111,751 | (1)(3)(5) |

11

Name of Beneficial Owner | Position | Ownership | |||

Alan L. Boeckmann | Director | 6,328 |

| ||

John J. Burns, Jr. | Director | 38,478 | (1)(2) | ||

Bill M. Lindig | Director | 26,587 | (1) | ||

Vilma S. Martinez | Director | 19,008 | (1)(3) | ||

Marc F. Racicot | Director | 5,750 |

| ||

Roy S. Roberts | Director | 27,477 | (1) | ||

Matthew K. Rose | Chairman, President, and Chief Executive Officer, Director | 1,186,600 | (4) | ||

Marc J. Shapiro | Director | 28,354 | (1) | ||

J.C. Watts, Jr. | Director | 0 |

| ||

Robert H. West | Director | 25,924 | (1) | ||

J. Steven Whisler | Director | 32,775 | (1)(5) | ||

Edward E. Whitacre, Jr. | Director | 30,967 | (1) | ||

Michael B. Yanney | Director | 54,098 | (1) | ||

Carl R. Ice | Executive Vice President and Chief Operations Officer | 517,178 | (4) | ||

Thomas N. Hund | Executive Vice President and Chief Financial Officer | 775,967 | (4) | ||

Charles L. Schultz | Executive Vice President | 901,479 | (4)(6) | ||

Jeffrey R. Moreland | Executive Vice President Law & Government Affairs and Secretary | 563,792 | (4) | ||

Directors and Executive Officers as a Group (20 persons) | 4,548,705 | (1)(3)(4) |

| (1) | The amounts reported include shares of restricted stock and restricted stock units issued under the Non-Employee Directors’ Stock Plan as follows: 1,578 for Director Boeckmann; 1,000 for Director Racicot; and 2,571 for each of Directors Burns, Lindig, Martinez, Roberts, Shapiro, West, Whisler, Whitacre, and Yanney; and 25,717 for all directors as a group. |

| The amounts reported include shares which may be acquired through presently exercisable stock options and stock options which will become exercisable within 60 days of February 28, 2003, under the Non-Employee Directors’ Stock Plan (or a predecessor plan) as follows: 4,750 for Directors Boeckmann and Racicot; 21,000 for each of Directors Burns, Roberts, Shapiro, West, Whisler, Whitacre and Yanney; 18,000 for Director Lindig; 15,000 for Director Martinez; and 189,500 for all directors as a group. |

| In addition to the amounts reported, certain Directors held phantom stock units under the Deferred Compensation Plan for Directors as of January 31, 2003, as follows: 9,976 for Director Burns; 627 for Director Roberts; 7,247 for Director Whisler; 22,831 for Director Yanney; and 40,681 for all directors as a group. |

| (2) | In addition, Director Burns is President and Chief Executive Officer and a director of Alleghany Corporation, which beneficially owns 16,000,000 shares of the Company’s common stock (approximately 4.26% of shares outstanding as of December 31, 2002). |

| (3) | Includes 469 shares Director Martinez holds through a retirement plan. |

| (4) | The amounts reported include shares of restricted stock held by executive officers as follows: 61,834 for Mr. Rose; 14,900 for Mr. Schultz; 30,800 for Mr. Ice; 65,740 for Mr. Hund; 36,795 for Mr. Moreland; and 269,891 for all executive officers as a group. In addition to the amounts reported, the following are phantom stock units held by executive officers pursuant to the Burlington Northern Santa Fe Senior Management Stock Deferral Plan: 128,463 for Mr. Rose; 14,900 for Mr. Schultz; 14,147 for Mr. Hund; 106,665 for Mr. Moreland; and 279,009 for all executive officers as a group. |

| The amounts reported include shares which may be acquired through presently exercisable stock options and stock options which will become exercisable within 60 days of February 28, 2003, as follows: 1,123,401 for Mr. Rose; 830,917 for Mr. Schultz; 461,497 for Mr. Ice; 615,616 for Mr. Hund; 500,670 for Mr. Moreland; and 3,747,579 for all executive officers as a group. |

| The amounts reported include share equivalents credited under the Investment and Retirement Plan, a 401(k) plan, as of January 31, 2003, as follows: 1,365 for Mr. Rose; 12,792 for Mr. Schultz; 9,076 for Mr. Moreland; and 26,253 for all executive officers as a group. |

| (5) | Includes 33 shares in which Mr. Whisler shares voting and investment power as co-trustee and co-beneficiary of a family revocable trust. |

| (6) | Includes 216 shares held by immediate family members as to which Mr. Schultz disclaims beneficial ownership, and 177 shares held in an IRA account. |

At the annual meeting, you and the other shareholders will elect 12 directors, each to hold office for a term of one year and until his or her successor has been elected and qualified. All incumbent directors, with the exception of The nominees for whom the shares represented by the enclosed proxy are intended to be voted, unless such authority is withheld, are identified below along with certain background information. We do not contemplate that any of these nominees will be unavailable for election but, if such a situation should arise, the proxy will be voted in accordance with the best judgment of the named proxies unless you have directed otherwise. Years served as a director of the Company includes prior service as directors of BNI, SFP and predecessor companies. No nominee, other than Mr. Rose, is or has been employed by or served as an executive officer of BNSF or its subsidiaries. Nominees for Director ALAN L. BOECKMANN, Director since 2001 Chairman and Chief Executive Officer of Fluor Corporation, Aliso Viejo, California (professional services holding company offering engineering, procurement, construction management and other services) since February 2002. Previously, President and Chief Operating Officer of Fluor Corporation from February 2001 to February 2002, President and Chief Executive Officer of Fluor Daniel (engineering, procurement, and construction services) from March 1999 to February 2001, Group President, Energy and Chemicals of Fluor Daniel from June 1997 to March 1999, and Group President, Chemical and Industrial Process of Fluor Daniel from January 1996 to June 1997. Also a director of Fluor Corporation. Member of BNSF’s Audit Committee and the Directors and Corporate Governance Committee. JOHN J. BURNS, JR., Director since 1995 President and Chief Executive Officer of Alleghany Corporation, New York, New York (holding company with casualty insurance, industrial minerals, and steel fastener distribution operations, and an investment position in Burlington Northern Santa Fe Corporation) since July 1992. Also a director of Alleghany Corporation and Fidelity National Financial, Inc. Member of BNSF’s Executive Committee and the Compensation and Development Committee. VILMA S. MARTINEZ, Director since 1998 Partner in Munger, Tolles & Olson LLP, Los Angeles, California (law firm) since September 1982. Also a director of Anheuser-Busch Companies, Inc., and Fluor Corporation. Member of BNSF’s Audit Committee and the Directors and Corporate Governance Committee.The amounts reported include shares which may be acquired within 60 days upon the exercise of stock options under the Non-Employee Directors' Stock Plan (or a predecessor plan) as follows: 18,000 for each of Messrs. Burns, Roberts, Shapiro, West, and Whisler; 27,000 for Dr. Weber and Mr. Whitacre; 15,000 for Mr. Lindig; 12,000 for Ms. Martinez; 21,000 for Mr. Yanney; and 192,000 for all directors as a group.In addition to the amounts reported, certain directors held phantom stock units under the Deferred Compensation Plan for Directors as of February 28, 2002, as follows: 8,419 for Mr. Burns; 619 for Mr. Roberts; 5,600 for Mr. Whisler; 20,935 for Mr. Yanney; and 35,573 for all directors as a group.(2)Mr. Burns is President and Chief Executive Officer and a director of Alleghany Corporation, which beneficially owns 17,949,242 shares of the Company's common stock (4.65% of shares outstanding as of December 31, 2001).(3)The amount reported includes 53,755 shares of restricted stock, 1,517,871 shares which may be acquired within 60 days upon the exercise of stock options (including 574,500 held in a family partnership to which Mr. Krebs disclaims beneficial ownership), and 34,618 shares held by a family partnership as to which Mr. Krebs disclaims beneficial ownership.(4)Includes 461 shares Ms. Martinez holds through a Retirement Savings Money Purchase Pension Plan.(5)The amounts reported include shares of restricted stock held by executive officers as follows: 131,902 for Mr. Rose; 14,900 for Mr. Schultz; 21,400 for Mr. Ice; 46,245 for Mr. Hund; 111,428 for Mr. Moreland; and 350,151 for all executive officers as a group. Of these restricted shares, the following are phantom share units held by executive officers pursuant to the Burlington Northern Santa Fe Senior Management Stock Deferral Plan: 50,985 for Mr. Rose; 14,900 for Mr. Schultz; 12,337 for Mr. Hund; 99,528 for Mr. Moreland; and 177,750 for all executive officers as a group.The amounts reported include shares which may be acquired within 60 days upon the exercise of stock options as follows: 880,933 for Mr. Rose; 697,217 for Mr. Schultz; 341,329 for Mr. Ice; 482,950 for Mr. Hund; 589,242 for Mr. Moreland; and 3,107,267 for all executive officers as a group.The amounts reported include share equivalents credited under the Investment and Retirement Plan, a 401(k) plan, as of February 28, 2002, as follows: 1,343 for Mr. Rose; 11,889 for Mr. Schultz; 8,927 for Mr. Moreland; and 22,159 for all executive officers as a group.(6)Includes 4,233 shares in which Mr. Whisler shares voting and investment power as co-trustee and co-beneficiary of a family revocable trust.(7)Includes 75 shares and 141 shares held by immediate family members as to which Mr. Schultz disclaims beneficial ownership, and 177 shares held in an IRA account.12Ms.Directors Martinez, and Messrs. Rose, Boeckmann, Racicot and Racicot,Watts initially became directors of the Company on September 22, 1995, with the business combination of Burlington Northern Inc. ("BNI"(“BNI”) and Santa Fe Pacific Corporation ("SFP"(“SFP”). Ms. Martinez was first elected in 1998Director Bill M. Lindig—who has served as a director since 1993—is retiring and Mr. Rose in 2000. Messrs. Boeckmann and Racicot were elected to the Board by the Board of Directors on September 14, 2001. Two directors will not stand for re-election: Robert D. Krebs, a director since 1983; and Arnold R. Weber, a director since 1986.re-election. All other incumbent directors have been nominated for re-election.5354Chairman and Chief Executive Officer of Fluor Corporation, Aliso Viejo, California (professional services holding company offering engineering, procurement, construction management and other services) since February 2002. Previously, President and Chief Operating Officer of Fluor Corporation from February 2001 to February 2002, President and Chief Executive Officer of Fluor Daniel from March 1999 to February 2001, Group President, Energy and Chemicals from June 1997 to March 1999, and Group President, Chemical and Industrial Process from January 1996 to June 1997. Also a director of Fluor Corporation. Member of BNSF's Audit Committee.7071President and Chief Executive Officer of Alleghany Corporation, New York, New York (holding company with reinsurance, industrial minerals, and steel fastener manufacturing operations, and an investment position in Burlington Northern Santa Fe Corporation) since July 1992. Also a director of Alleghany Corporation and Fidelity National Financial, Inc. Member of BNSF's Executive Committee and Compensation and Development Committee.13BILL M. LINDIG, 65Director since 1993Retired Chairman of SYSCO Corporation, Houston, Texas (marketer and distributor of foodservice products) since July 2000, a position he had held since January 2000. Previously, Chairman and Chief Executive Officer from January 1999 to January 2000 and, from January 1995 to January 1999, President and Chief Executive Officer, of SYSCO Corporation. Also a director of SYSCO Corporation. Member of BNSF's Compensation and Development Committee and Directors and Corporate Governance Committee.5859

MARC F. RACICOT, | Director since 2001 |

Partner, Bracewell & Patterson, L.L.P., Washington, D.C. (law firm) since February 2001, and Chairman, Republican National Committee, Washington, D.C. (political organization) since January 2002. Previously, Governor of the State of Montana from 1993 to 2001. Also a director of Siebel Systems, Inc. and Massachusetts Mutual Life Insurance Company. Member of BNSF’s Executive Committee and the Directors and Corporate Governance Committee.

ROY S. ROBERTS, | Director since 1993 |

Retired Group Vice President, North American Vehicle Sales, Service and Marketing of General Motors Corporation, Detroit, Michigan (manufacturer of motor vehicles) since April 2000, a position he had held since July 1999. Previously, Vice President and Group Executive, North American Vehicle Sales, Service and Marketing from October 1998 to July 1999; Vice President and General Manager, Field Sales, Service and Parts from August 1998 to October 1998; and, from February 1996 to August 1998, Vice President and General Manager of Pontiac-GMC Division of General Motors Corporation. Also a director of Abbott Laboratories. Member of BNSF’s Compensation and Development Committee and the Directors and Corporate Governance Committee.

MATTHEW K. ROSE, | Director since 2000 |

Chairman, President and Chief Executive Officer of Burlington Northern Santa Fe Corporation since March 2002. Also, Chairman, President and Chief Executive Officer of The Burlington Northern and Santa Fe Railway Company. Previously, President and Chief Executive Officer of Burlington Northern Santa Fe Corporation since December 2000; President and Chief Operating Officer of the Company from June 1999; Senior Vice President and Chief Operations Officer from August 1997 to June 1999; and, from May 1996 to August 1997, Senior Vice President-Merchandise Business Unit. Chairman of BNSF’s Executive Committee.

MARC J. SHAPIRO, | Director since 1995 | |

Vice Chairman for Finance, Risk Management, and Administration of J.P. Morgan Chase & Co., New York, New York (bank holding company) since January 2001. Previously, Vice Chairman for Finance, Risk Management and Administration of The Chase Manhattan Corporation, New York, New York (bank holding company) from July 1997 to December 2000, and Chairman and Chief Executive Officer, Chase Bank of Texas N.A., Houston, Texas (banking) from 1989 to July 1997. Also a director of Kimberly-Clark Corporation and a trustee of Weingarten Realty Investors. Member of BNSF’s Audit Committee and the Directors and Corporate Governance Committee.

J.C. WATTS, JR., 45 | Director since January | |

2003 |

14

Chairman, J.C. Watts Companies LLC, and J.C. Watts Enterprises, Inc., Norman, Oklahoma (communications and public affairs). Member of Congress (R-4th Dist.-OK) from January 1995 to January 2003 and Chairman of House Republican Conference from 1998-2002. Also a Director of Dillards, Inc., Terex Corporation, and Clear Channel Communications Inc.

ROBERT H. WEST, | Director since 1980 |

Retired Chairman of the Board of Butler Manufacturing Company, Kansas City, Missouri (manufacturer of pre-engineered building systems and specialty components), a position he had held from January 1999 to July 1999. Previously, Chairman and Chief Executive Officer of Butler Manufacturing Company from May 1986 to January 1999. Also a director of Astec Industries, Inc., Commerce Bancshares, Inc. and Great Plains Energy Incorporated. Chairman of BNSF’s Audit Committee and member of the Executive Committee and the Compensation and Development Committee.

J. STEVEN WHISLER, | Director since 1995 |

Chairman, President and Chief Executive Officer, Phelps Dodge Corporation, Phoenix, Arizona (mining and manufacturing) since May 2000. Previously, President and Chief Executive Officer of Phelps Dodge Corporation from January 2000 to May 2000; President and Chief Operating Officer from December 1997 to January 2000; and from October 1988 to December 1997, Senior Vice President of Phelps Dodge Corporation. Also, President of Phelps Dodge Mining Company, a division of Phelps Dodge Corporation, from November 1991 to September 1998. Also a director of Phelps Dodge Corporation, Southern Peru Copper Corporation, and America West Holdings Corporation and its subsidiary, America West Airlines, Inc. Member of BNSF’s Audit Committee and the Compensation and Development Committee.

EDWARD E. WHITACRE, JR., | Director since 1993 |

Chairman and Chief Executive Officer, SBC Communications Inc., San Antonio, Texas (communications holding company) since January 1990. Also a director of Anheuser-Busch Companies, Inc., Emerson Electric Co., The May Department Stores Company, and SBC Communications Inc. Chairman of BNSF’s Directors and Corporate Governance Committee and member of the Executive Committee.

MICHAEL B. YANNEY, | Director since 1989 | |

Chairman, America First Companies L.L.C., Omaha, Nebraska (investments) since August 2001. Previously, Chairman and Chief Executive Officer from October 2000, and Chairman, President and Chief Executive Officer from 1984. Also a director of Forest Oil Corporation, Level 3 Communications, Inc., MFA Mortgage Investments, Inc., and RCN Corporation. Chairman of BNSF’s Compensation and Development Committee and member of the Executive Committee.

APPROVAL OF AMENDMENT OF THE BURLINGTON NORTHERNSANTA FE 1999 STOCK INCENTIVE PLAN

We recommend a voteFOR all of the above nominees.

15

ON The following report on The The Committee believes that compensation programs should reflect the Philosophical Principles Specific Program ObjectivesPurposesThe Stock Plan was established to:•attract and retain executive, managerial and other salaried employees;•motivate employees to achieve long-range goals;•provide incentive compensation opportunities that are competitive with other major companies; and•further align our employees' interests with those of all our shareholders through stock-based compensation.Stock IncentivesUnder the Stock PlanWe believe the use of stock incentives will promote the growth in value of our stock and the enhancement of long-term shareholder return.The types of stock incentives authorized are:•stock options;•restricted stock and restricted stock units;•performance stock; and•a stock purchase program.The Stock Plan has been used since 1999 and will be used for future stock awards. On March 6, 2002, the Company's common stock closed at $31.30 on the New York Stock Exchange. Awards of restricted stock, restricted units, and performance stock are cumulatively limited to four million shares for the life of the Stock Plan, but this limit will increase to five million shares upon approval of the amended Stock Plan.The Stock Plan, as amended last year, authorized up to 29 million shares to be used for stock awards. As of the close of business on February 28, 2002, an aggregate of 3,760,816 shares of the Company's common stock remained available for future grants under the existing Stock Plan, and there were outstanding awards (options plus restricted shares) of 22,041,395 shares. If the amendment is approved, 9,760,816 shares would be available for future grants overall, and 4,009,704 shares would be available for grant in the form of restricted stock, restricted stock units, or performance stock based on the shares issued and awards outstanding at February 28, 2002. Shares related to awards which terminate by expiration, forfeiture, cancellation or otherwise without the issuance of shares, or which are settled in cash in lieu of common stock, and shares used to pay an option exercise price will be available for grant under the plan.16The full text of the Burlington Northern Santa Fe 1999 Stock Incentive Plan, as proposed to be amended, is presented in Appendix I to this proxy statement. The following is a summary of the major provisions of the Stock Plan and is qualified in its entirety by the full text of the plan itself.AdministrationThe Compensation and Development Committee of the Board of Directors (the "Committee") administers the Stock Plan. The Committee consists of directors who are not employees or officers of the Company and must have at least two members who are "non-employee directors" within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934. Committee members may not participate in the Stock Plan. The Committee is authorized to interpret the Stock Plan, to establish rules and regulations for its operation, to select the employees eligible to receive awards, and to determine the type, amount, and terms and conditions of awards.Eligibility for ParticipationAll salaried employees of BNSF or its subsidiaries are eligible to be selected to participate in the Stock Plan. The Committee selects all participants in its discretion. BNSF and its subsidiaries currently employ approximately 4,800 salaried individuals.Amendment and Terminationof the Stock PlanThe Board may suspend, amend or terminate the Stock Plan at any time, with or without prior notice, but it may not, without shareholder approval, increase the aggregate number of shares which may be issued under the plan, adopt any amendment which would materially increase the benefits accruing to participants or materially modify eligibility requirements for participation in the plan. The Stock Plan will remain in effect until terminated by the Board.Limitation on AwardsNo participant may receive any award of a stock option to the extent that the sum of the number of shares subject to the award, and the number of shares subject to prior awards of options under the Stock Plan or other plans during a one-year period ending on the date of grant, exceeds one million shares. The Stock Plan authorizes a maximum of four million shares which may be granted for all participants in the form of restricted stock, restricted stock units or performance stock under the Stock Plan, of which 3,009,704 remain available for grant as of February 28, 2002. If the amendment is approved, this limit would be increased to five million shares, and 4,009,704 shares would be available for future grants, based on the shares issued and awards outstanding at February 28, 2002.Stock OptionsThe Committee may grant awards in the form of incentive stock options and non-qualified stock options to purchase shares of the Company's common stock. This will include option grants to certain senior executives in an amount equal to the number of shares tendered to pay an option exercise price. The Committee will determine the number of shares subject to each option, the manner and time of the option's exercise, the terms and conditions applicable to the award, and the exercise price per share of stock subject to the option. The exercise price of a stock option must be no less than the fair market value of the Company's common stock on the date of grant. Upon exercise, the option price may be paid by a participant in cash, shares of common stock, a combination of the two or other consideration as the Committee may deem appropriate. Any stock option granted in the form of an incentive stock option will satisfy the applicable requirements of Section 422 of the Internal Revenue Code.17Restricted StockGrants of shares of restricted stock or restricted stock units will be subject to such terms, conditions, restrictions or limitations as the Committee deems appropriate, including restrictions on transferability and continued employment. The plan gives the Committee the discretion to accelerate the delivery of a restricted stock award.Performance StockThe Stock Plan allows for the grant of performance stock awards which are contingent upon the attainment of certain performance objectives determined by the Committee. The performance objectives to be achieved during the performance period and the measure of whether and to what degree such objectives have been attained will also be determined by the Committee.Stock Purchase ProgramThe Committee may establish programs enabling participants to purchase common stock at not less than 75 percent of the fair market value at the time of purchase (or an average stock value over a determined period). The Committee designates eligible participants. Restrictions such as those imposed with respect to restricted stock may be imposed on shares purchased under this program.Change in Control/Change in OwnershipIn the event of a "change in control" (as defined in the Stock Plan), all options, restricted stock, restricted stock units, performance shares, and shares acquired under a stock purchase arrangement will become fully vested.In general, the Stock Plan defines a "change in control" as occurring if: (a) any "person" becomes the beneficial owner of securities representing 25 percent or more of the voting power of the Company's outstanding securities; or (b) during any period of two consecutive years, individuals who at the beginning of such period constitute the Board of Directors of the Company, and any new directors approved by at least two-thirds of the existing directors, cease to constitute at least a majority of the Board; or (c) the Company's shareholders approve a merger or consolidation of BNSF with another company, with certain exceptions; or (d) the Company's shareholders approve a plan of complete liquidation or an agreement for the sale or disposition by the Company of all or substantially all of its assets. However, a merger or other business combination with a Class I railroad or holding company of a Class I railroad will not constitute a change in control unless the Board so determines.18Other Terms of AwardsThe Stock Plan provides for the forfeiture of awards in the event of termination of employment except in the circumstances described below. In the event employment terminates by reason of death, all awards will vest. In the event termination occurs by reason of disability or retirement, all awards will vest ratably except that the proportion of awards subject to performance criteria will remain subject to the performance criteria. In the event of termination by the Company other than for cause, all performance-based awards will be forfeited and all other awards will vest ratably. In the event of death, disability, retirement or termination by the Company other than for cause, stock options will be exercisable for five years. In no event shall any options be exercisable later than the scheduled expiration date.The Committee may establish such other terms, conditions, restrictions, or limitations governing the grant of awards as are not inconsistent with the plan.Federal IncomeTax ConsequencesAn employee who has been granted an incentive stock option will not realize taxable income and the Company will not be entitled to a deduction at the time of the grant or exercise of such option. If the employee makes no disposition of shares acquired pursuant to an incentive stock option within two years from the date of grant of such option, or within one year of the transfer of the shares to such employee, any gain or loss realized on a subsequent disposition of the shares will be treated as a long-term capital gain or loss. Under these circumstances, the Company will not be entitled to any deduction for Federal income tax purposes. If these holding period requirements are not satisfied, the employee will generally realize ordinary income at the time of the disposition in an amount equal to the lesser of (i) the excess of the fair market value of the shares on the date of exercise over the option price or (ii) the excess of the amount realized upon disposition of the shares, if any, over the option price, and the Company will be entitled to a corresponding deduction.An employee will not realize taxable income at the time of the grant of a non-qualified option. Upon exercise, however, the employee will realize ordinary income equal to the excess, if any, of the fair market value of the shares on the date of exercise over the option price, and the Company will be entitled to a corresponding deduction. Upon subsequent disposition of the shares, the employee will realize short-term or long-term capital gain or loss, with the basis for computing such gain or loss equal to the option price plus the amount of ordinary income realized upon exercise.19An employee who has been granted a restricted stock award will not realize taxable income at the time of grant, and the Company will not be entitled to a deduction at that time, assuming that the restrictions constitute a substantial risk of forfeiture for Federal income tax purposes. Upon the vesting of shares subject to an award, the holder will realize ordinary income in an amount equal to the fair market value of the shares at such time, and the Company will be entitled to a corresponding deduction. Dividends paid to the holder during the restriction period will also be compensation income to the employee and deductible as such by the Company. The holder of a restricted stock award may elect to be taxed at the time of grant of the award on the then fair market value of the shares, in which case (i) the Company will be entitled to a deduction at the same time and in the same amount, (ii) dividends paid to the holder during the restriction period will be taxable as dividends to the holder and not deductible by the Company, and (iii) there will be no further tax consequences when the restrictions lapse. If an employee who has made such an election subsequently forfeits the shares, he or she will not be entitled to any deduction or loss. The Company, however, will be required to include as ordinary income the lesser of the fair market value of the forfeited shares or the amount of the deduction originally claimed with respect to the shares.Board RecommendationThe Committee and the Board of Directors believe that the Stock Plan has assisted the Company in attracting, motivating and retaining key employees. We believe that stock awards are an important part of the Company's incentive compensation of officers, managers, and other salaried employees. These kinds of stock-based awards further align management's interests with those of our shareholders because their value appreciates to the extent that the market price of the Company's stock increases. Therefore, we recommend that shareholders vote to approve the Burlington Northern Santa Fe 1999 Stock Incentive Plan, as proposed to be amended.The Board of Directors unanimously recommends a voteFOR approval of the Burlington Northern Santa Fe 1999 Stock Incentive Plan, as proposed to be amended.20

COMPENSATION AND DEVELOPMENT COMMITTEE REPORT20012002 EXECUTIVE COMPENSATION 20012002 executive compensation is presented by the Compensation and Development Committee of the Board (the "Committee"“Committee”), which has responsibility for reviewing and making recommendations to the Board for executive compensation. This includes establishing and reviewing executive base salaries, administering the annual Incentive Compensation Plan as it relates to executive officers, and administering equity-based compensation under the Burlington Northern Santa Fe 1999 Stock Incentive Plan, as amended ("(“Stock Plan"Plan”) and predecessor plans. The Committee consists of independent, non-employee directors, who have no interlocking relationships with the Company.

BNSF VisionCompany'sCompany’s vision is to realize its tremendous potential by providing transportation services that consistently meet or exceed customers'our customers’ expectations. Benchmarks are identified against which the Company can measure its success in meeting the needs of its primary constituencies—customers, shareholders, employees, and communities. The Company'sCompany’s executive compensation programs help the Company realize its vision and support its business strategies.

Philosophies and ObjectivesCompany'sCompany’s compensation philosophy and support specific compensation objectives. The Committee also believes that programs designed specifically for executives should exemplify the Company'sCompany’s compensation philosophy and reflect executives'executives’ roles as key decision-makers. The philosophical principles and specific objectives are noted below.Philosophical Principles•Compensation programs should encourage strong operating and financial performance.•Compensation programs should help create a shared sense of direction, ownership, and commitment.•The Company should emphasize performance-based compensation ("pay at risk") through both cash and equity-based incentives.Specific Program Objectives•The compensation program should attract and retain key employees and managers by providing competitive opportunities.21Compensation programs should encourage strong operating and financial performance.Compensation programs should help create a shared sense of direction, ownership, and commitment.The Company should emphasize performance-based compensation (“pay at risk”) that provides greater rewards for stronger performance through both cash and equity-based incentives.The compensation program should attract and retain key employees and managers by providing competitive opportunities.The programs should focus employees on operating performance that will maximize the value of the Company’s operations.The programs should focus employees on building the profitability and fundamental value of the Company, which ultimately should impact the value of the stock, thus enabling employees to realize gains if the Company attains its performance objectives.

Competitive Compensation Objectives | The Committee has established external competitive benchmarks for each element of compensation which it believes fully support the principles outlined above. The market for assessing compensation is defined as companies from general industry with revenue comparable to the Company. The group of comparators used for these analyses will be broader than that used for the peer group index reflected in the Performance Graph following this report. The Committee believes that the | |||

The | ||||

22

Annual Cash Compensation | Base Salaries. The Company considers various factors in assigning executives to specific salary ranges, including job content, level of responsibility, accountability, and | |||

Incentive Compensation Plan. Executives are eligible for annual performance-based awards under the | ||||

salaried employees. For |

The actual incentives earned by Messrs. Ice, Schultz, | ||||

For | ||||

| To encourage ownership in the Company and to align | |||

Stock Ownership Goals. A commitment to significant stock ownership on the part of the Company management is an important element of the compensation programs. The Committee established | ||||

23

Executive Level |

(As a Multiple of Salary) | ||||

Chairman, President and Chief Executive Officer | 5 x Base Salary | ||||

Executive Vice Presidents | 3 | ||||

Vice Presidents and Senior Managers in Salary Band 36 | 2 | ||||

Senior Managers in Salary Bands 34 and 35 | 1 |

Each executive and senior manager covered by the goals is required to retain the net, after-tax shares obtained through option exercises, or through vested restricted stock, until he or she accumulates the required ownership levels. The Committee monitors total share holdings on an annual basis. All executive officers, |

Incentive Bonus Stock Program. To encourage individual stock ownership, executives and senior managers are given the opportunity to exchange up to 100 percent of their ICP cash awards for a grant of restricted stock. Participants electing the exchange receive a restricted stock grant equal to 150 percent of the ICP award foregone. Shares vest three years after grant, but shares awarded in 2002 may vest in two years upon attainment of certain pre-specified |

Salary Exchange Option Program. To reinforce the link between stock price performance and executive compensation, executives and selected senior managers have the opportunity to exchange up to 25 percent of their base salary each year for a grant of non-qualified stock options with an exercise price equal to the fair market value of the | ||

24

Senior Management Stock Deferral Plan. The Senior Management Stock Deferral Plan provides management with retirement and tax planning flexibility. The plan allows senior |

|

CEO Compensation | The factors upon which Mr. |

The Committee assesses the Chief Executive | ||

25

Mr. |

On |

Mr. |

Actual awards for Mr. Rose and others reflect operating income that was below the threshold level of performance, and a free cash flow achievement level that was midway between threshold and target. |

| Section 162(m) of the Internal Revenue Code limits the tax deductibility by a company of compensation in excess of $1 million paid to any of its most highly compensated executive officers. However, performance-based compensation that has been approved by shareholders is excluded from the $1 million limit if, among other requirements, the compensation is payable only upon attainment of pre-established, objective performance goals and the board committee that establishes such goals consists only of | |

” |

26

The Committee has considered these requirements and the regulations. While the tax impact of any compensation arrangement is one factor to be considered, this impact is evaluated by the Committee in light of the |

by providing compensation that is not fully deductible, and that its ability to exercise discretion outweighs the advantages of qualifying compensation under Section 162(m). |

Compensation and Development Committee: |

Michael B. Yanney, Chairman |

John J. Burns, Jr. |

Bill M. Lindig |

Roy S. Roberts |

Robert H. West |

J. Steven Whisler |

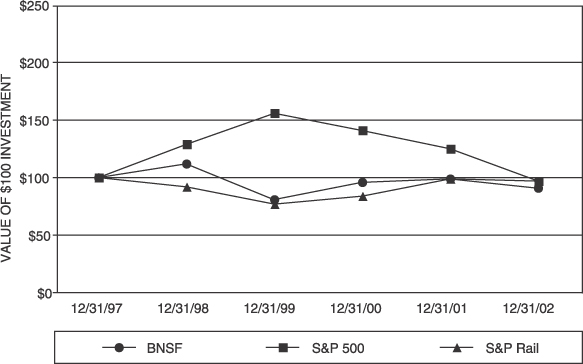

The following graph depicts a five year comparison of cumulative total stockholder returns for the Company, the Standard & Poor’s 500 Stock Index (“S&P 500”), and the Standard & Poor’s Railroad Index (“S&P Rail”). The Company is included within both the S&P 500 and S&P Rail indices. The graph assumes the investment of $100 on December 31, 1997, in the Company’s common stock, the S&P 500, and the S&P Rail, and the reinvestment of all dividends. |

27

December 31 | BNSF | S&P 500 | S&P Rail | ||||||

1997 | $ | 100 | $ | 100 | $ | 100 | |||

1998 | $ | 112 | $ | 129 | $ | 92 | |||

1999 | $ | 81 | $ | 156 | $ | 77 | |||

2000 | $ | 96 | $ | 141 | $ | 84 | |||

2001 | $ | 98 | $ | 125 | $ | 99 | |||

2002 | $ | 91 | $ | 97 | $ | 97 | |||

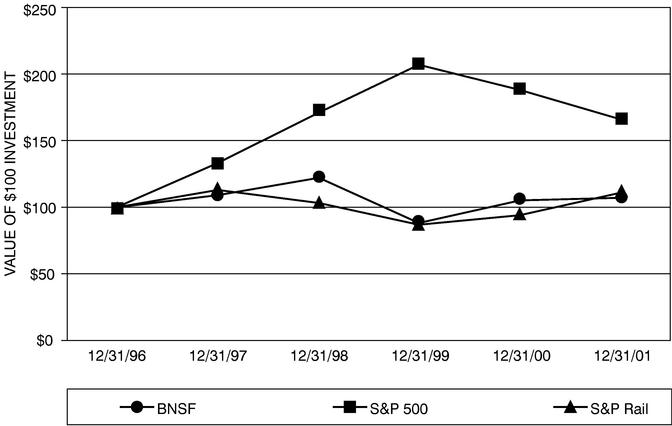

The following graph depicts a five year comparison of cumulative total stockholder returns for the Company, the Standard & Poor's 500 Stock Index ("S&P 500"), and the Standard & Poor's Railroad Index ("S&P Rail"). The Company is included within both the S&P 500 and S&P Rail indices. The graph assumes the investment of $100 on December 31, 1996, in the Company's common stock, the S&P 500, and the S&P Rail, and the reinvestment of all dividends.

| December 31 | BNSF | S&P 500 | S&P Rail | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 1996 | $ | 100 | $ | 100 | $ | 100 | |||

| 1997 | $ | 109 | $ | 133 | $ | 113 | |||

| 1998 | $ | 122 | $ | 171 | $ | 103 | |||

| 1999 | $ | 88 | $ | 207 | $ | 87 | |||

| 2000 | $ | 105 | $ | 188 | $ | 94 | |||

| 2001 | $ | 107 | $ | 166 | $ | 111 | |||

28

The following table summarizes the compensation earned by our Chief Executive Officer and each of the other four most highly compensated executive officers in |

Annual Compensation | Long-Term Compensation Awards | ||||||||||||||||||||||||||||||||

| Year | Salary(1) | Bonus(2) | Restricted Stock(2)(3) | Securities Underlying Options (Shares) | ||||||||||||||||||||||||||||

All Other Compensation(4) | |||||||||||||||||||||||||||||||||

Matthew K. Rose Chairman, President and Chief Executive Officer | 2002 2001 2000 | $ $ $ | 805,996 676,000 461,682 | $ $ $ | 312,228 15,000 154,079 | $ $ $ | 1,904,289 1,350,451 2,559,563 | 245,000 350,000 282,400 | $ $ $ | 88,322 47,725 41,532 | |||||||||||||||||||||||

Carl R. Ice Executive Vice President and Chief Operations Officer | 2002 2001 2000 | $ $ $ | 359,750 350,000 270,000 | $ $ $ | 420,489 224,873 139,422 | $ $ $ | 424,193 438,746 0 | 78,000 114,226 149,250 | $ $ $ | 38,233 24,658 21,388 | |||||||||||||||||||||||

Charles L. Schultz Executive Vice President (5) | 2002 2001 2000 | $ $ $ | 341,900 324,400 292,000 | $ $ $ | 309,143 200,170 190,443 | $ $ $ | 410,421 424,501 0 | 56,000 80,500 247,300 | $ $ $ | 32,116 24,721 28,443 | |||||||||||||||||||||||

Thomas N. Hund Executive Vice President and Chief Financial Officer | 2002 2001 2000 | $ $ $ | 304,875 282,000 247,000 | $ $ $ | 0 0 14,210 | $ $ $ | 882,445 664,907 263,246 | 112,748 92,528 224,050 | $ $ $ | 31,974 23,261 14,973 | |||||||||||||||||||||||

Jeffrey R. Moreland Executive Vice President Law & Government Affairs and Secretary | 2002 2001 2000 | $ $ $ | 220,900 201,900 172,800 | $ $ $ | 0 174,039 12,348 | $ $ $ | 884,257 339,031 234,442 | 80,637 92,195 235,406 | $ $ $ | 167,909 96,464 101,337 | |||||||||||||||||||||||

| (1) | Salary has been reduced by the amounts foregone for participation in the Salary Exchange Option Program by Messrs. Rose, Ice, Schultz, Hund and Moreland, and for participation in the Company’s Estate Enhancement Program for Mr. Moreland in 2002, 2001, and 2000. |

| (2) | The bonus awards for the individuals named above were paid pursuant to the annual incentive compensation plan described in the Compensation and Development Committee Report on 2002 Executive Compensation in this proxy statement. Messrs. Rose and Hund elected to forego all or a portion of their annual incentives pursuant to the Incentive Bonus Stock Program or the Senior Management Stock Deferral Plan in exchange for restricted stock or restricted stock units in 2002, 2001 and 2000. Mr. Moreland made a similar election as to 2002 and 2000. In 2002, Mr. Moreland’s annual incentive was also reduced for his participation in the Company’s Estate Enhancement Program. |

| (3) | Mr. Rose was granted 300,000 shares of restricted stock on April 20, 2000, which consisted of 100,000 shares valued at $2,378,000 that vest in equal installments over three years, and 200,000 shares valued at $4,756,000 that were to vest in two equal annual installments following the proposed combination of BNSF and Canadian National Railway Company. Upon the public announcement of the mutual termination of the combination on July 14, 2000, the latter 200,000 shares were cancelled. |

| Restricted shares and corresponding market value owned by the individuals named above on December 31, 2002, based upon a per share value of $25.92, are shown below. Dividends are paid on restricted stock. No shares vest in less than three years except for grants made in 2002 under the Incentive Bonus Stock Program which may vest in two years if certain Company pre-specified free cash performance goals are achieved. |

Named Executive | Shares of Restricted Stock | Market Value | |||

Matthew K. Rose | 115,730 | $ | 2,999,722 | ||

Carl R. Ice | 30,800 | $ | 798,336 | ||

Charles L. Schultz | 29,800 | $ | 772,416 | ||

Thomas N. Hund | 59,149 | $ | 1,533,142 | ||

Jeffrey R. Moreland | 31,681 | $ | 821,172 | ||

| (4) | For 2002, reflects matching contributions to the Burlington Northern Santa Fe Investment and Retirement Plan and the Burlington Northern Santa Fe Supplemental Investment and Retirement Plan. In addition, in connection with his participation in the Company’s Estate Enhancement Program, $143,367 is reflected for Mr. Moreland. |

| (5) | In 2002, Mr. Schultz’s title was Executive Vice President and Chief Marketing | |||||||||||||||||

One owner of 123 shares of the Company's common stock has given notice that he intends to introduce the following proposal and has furnished the following statement in support of the proposal. The Company will provide the proponent's name and address to shareholders promptly upon receiving an oral or written request.

35

Proposal

Resolved: That shareholders urge that the board of directors will solicit shareholder approval for any "shareholder rights" plan that might be adopted, and that if this approval is not granted in the form of a majority of the shares voted, then any rightsBoard;

Supporting Statement

Shareholder rights plans, sometimes called "poison pills," may be adopted by boards at any time. Such board action presumes a knowledge of what is bestcomplete liquidation or an agreement for shareholders. Yet I believe shareholders frequently oppose "pills" when they are asked in a vote.

This resolution merely urges the board to secure shareholder approval if and when a pill is put in placesale or disposition by the board. Companies such as Texaco and Compaq have instituted the policy imbedded in this resolution and understandably highlight it as a signCompany of shareholder accountability. Last year, management argued that "The Board believes it is important that it retain the flexibility to adopt a rights plan without having to conduct a shareholder vote in order to maintain the plan." A majority of shareholders rejected this agreement when they voted to support the above resolution. Broadly, the poison pill and a board's actions to establish them without shareholder vote have come to signify management insulation.

By supporting this resolution, shareholders can signal that [they] will hold the board to the highest standards of accountability.

The Company's Response

Your directors recommend a vote AGAINST this proposal.

The Board of Directors believes that the action requested in the shareholder proposal is neither needed nor advisable. BNSF does not have a rights plan (sometimes called a "poison pill") in place, and it has no present intention of adopting one. Future developments might, under certain circumstances, compel the Board to consider adoption of a rights plan as a means to protect shareholders' interests in the exercise of the Board's fiduciary duties. Requiring a shareholder vote on any rights plan adopted could hinder the Board's ability to use a rights plan to protect shareholder interests.

A rights plan is designed to improve the Board's ability to protect and advance the interests of BNSF andall or substantially all of its shareholders, especially in the face of unfair and abusive takeover tactics. It enhances the ability of the Board to negotiate with potential acquirers and discourages coercive or low-ball takeover tactics that would operate to the detriment of BNSF shareholders. A requirement that we seek shareholder approval for any rights plan could seriously weaken the Board's negotiating position in a hostile situation and leave it less able to protect shareholder interests.assets.

Our recommendation that shareholders vote against this proposal does not mean that the Board has determined a rights plan should be adopted. Consideration of a rights plan would be made only after informed and careful deliberation by the Board in the exercise of its fiduciary duties on behalf of shareholders. The Board believes that it will best be able to maximize shareholder value if it retains the ability to adopt a plan in the future, if warranted in its judgment based on circumstances then prevailing, to preserve and protect shareholder interests. For these reasons, we believe that adoption of the proposal would not be in the best interest of our shareholders.

We recommend that shareholders voteAGAINSTthis proposal.

36

PricewaterhouseCoopers LLP served as the independent public accountant for the Company in |

Audit Fees. The aggregate fees and expenses billed by PricewaterhouseCoopers LLP for professional services rendered for the audit of the |

All Other Fees. The aggregate fees and expenses billed by PricewaterhouseCoopers LLP for professional services rendered to the Company, other than the services described under |

This report is submitted by the Audit Committee of the Board of Directors. |

The Board of Directors |

In the performance of our oversight function, we have reviewed and discussed the audited financial statements with management and the Company’s independent public accountant, PricewaterhouseCoopers LLP. We have also discussed with PricewaterhouseCoopers LLP the matters required to be discussed by Statements on Auditing Standards No. 61 (Communication with Audit Committees) and No. 90 (Audit Committee Communications). In addition, we have received the written disclosures and the letter from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) and discussed with them their independence from the Company and management. We have concluded, after review, that the non-audit services provided by PricewaterhouseCoopers LLP are not incompatible with their independence. |

As set forth in the Committee’s charter, management is responsible for the preparation, presentation and integrity of the | ||

37

Based on our review and the discussions described above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the |

Audit Committee: |

Robert H. West, Chairman |

Alan L. Boeckmann |

Bill M. Lindig |

Vilma S. Martinez |

Marc J. Shapiro |

J. Steven Whisler |

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers to file reports of holdings of and transactions in |

from these persons, we believe that all Securities and Exchange Commission beneficial ownership reporting requirements for |

38

Shareholder Proposals for Annual Meeting in |

Other Shareholder Business at Annual Meeting in |

Shareholder Nomination of Directors. The Directors and Corporate Governance Committee will consider candidates for election as director as recommended by shareholders. Any such recommendation, together with the |

If any matters other than those set forth above are properly brought before the meeting, including any shareholder |

If you are going to vote by mail, we encourage you to specify your choices by marking the appropriate boxes on the enclosed proxy card. However, you do not need to mark any boxes if you wish to vote according to the Board of | ||

39

By order of the Board of Directors. |

Jeffrey R. Moreland |

Executive Vice President Law & Government Affairs and Secretary |

March 11, |

40

APPENDIX I

BURLINGTON NORTHERN SANTA FE 1999 STOCK INCENTIVE PLAN,AS AMENDED

SECTION 1

STATEMENT OF PURPOSE

1.1. The BURLINGTON NORTHERN SANTA FE 1999 STOCK INCENTIVE PLAN (the "Plan") has been established by BURLINGTON NORTHERN SANTA FE CORPORATION (the "Company") to:

and thereby promote long-term financial interest of the Company and the Related Companies, including the growth in value of the Company's equity and enhancement of long-term stockholder return.

SECTION 2

DEFINITIONS

2.1. Unless the context indicates otherwise, the following terms shall have the meanings set forth below:

I-1

directly or indirectly, of securities of the Company representing 25% or more of the combined voting power of the Company's then outstanding securities;

Notwithstanding the foregoing, a merger, consolidation, acquisition of common control, or business combination of the Company and a Class I Railroad or a holding company of a Class I railroad that is approved by the Board shall not constitute a "Change in Control" unless the Board makes a determination that the transaction shall constitute a "Change in Control".

I-2

I-3

SECTION 3

ELIGIBILITY

3.1. The Committee shall determine and designate from time to time, from among the salaried, full-time officers and employees of the Employers those Employees who will be granted one or more awards under the Plan.

SECTION 4

OPERATION AND ADMINISTRATION

4.1. Subject to the approval of the stockholders of the Company at the Company's 1999 annual meeting of the stockholders, the Plan shall be effective as of January 1, 1999 ("Effective Date"), provided however, that any awards made under the Plan prior to approval by stockholders, shall be contingent on approval of the Plan by stockholders of the Company and all dividends on Awards shall be held by the Company and paid only upon such approval and all other rights of a Participant in connection with an Award shall not be effective until such approval is obtained. The Plan shall be unlimited and remain in effect until termination by the Board, provided however, that no Incentive Stock Options may be granted under the Plan on a date that is more than ten years from the Effective Date or, if earlier, the date the Plan is adopted by the Board.

4.2. The Plan shall be administered by the Compensation and Development Committee of the Board ("Committee") which shall be selected by the Board, shall consist solely of members of the Board who are not employees or officers of the Company or any Related Company and are not eligible to participate in the Plan, and shall consist of not less than two members of the Board who meet the definition of a "Non-Employee Director" under SEC Rule 16b-3 or such greater number as may be required for compliance with SEC Rule 16b-3. The authority to manage and control the operation and administration of the Plan shall be vested in the Committee, subject to the following:

I-4

into account the nature of services rendered by the respective Employee, his present and potential contribution to the Company's success, and such other factors as the Committee deems relevant.

4.3. Notwithstanding any other provision of the Plan to the contrary, no Participant shall receive any Award of an Option under the Plan to the extent that the sum of:

I-5

would exceed the Participant's Individual Limit under the Plan. The determination made under the foregoing provisions of this subsection 4.3 shall be based on the shares subject to the awards at the time of grant, regardless of when the awards become exercisable. Subject to the provisions of Section 13, a Participant's "Individual Limit" shall be 1,000,000 shares per calendar year.

4.4. To the extent that the Committee determines that it is necessary or desirable to conform any Awards under the Plan with the requirements applicable to "Performance-Based Compensation", as that term is used in Code section 162(m)(4)(c), it may, at or prior to the time an Award is granted, take such steps and impose such restrictions with respect to such Award as it determines to be necessary to satisfy such requirements. To the extent that it is necessary to establish performance goals for a particular performance period, those goals will be based on one or more of the following business criteria: net income, earnings per share, debt reduction, safety, on-time train performance, return on investment, operating ratio, cash flow, return on assets, stockholders return, revenue, customer satisfaction, and return on equity. If the Committee establishes performance goals for a performance period relating to one or more of these business criteria, the Committee may determine to approve a payment for that particular performance period upon attainment of the performance goal relating to any one or more of such criteria.

SECTION 5

SHARES AVAILABLE UNDER THE PLAN

5.1 The shares of Stock with respect to which Awards may be made under the Plan shall be shares currently authorized but unissued or treasury shares acquired by the Company, including shares purchased in open market or in private transactions. Subject to the provisions of Section 12, the total number of shares of Stock available for grant of Awards shall not exceed thirty-five million (35,000,000) shares of Stock. Except as otherwise provided herein, any shares subject to an Award which for any reason expires or is terminated without issuance of shares (whether or not cash or other consideration is paid to a Participant in respect to such Award) as well as shares used to pay an Option Purchase Price under this Plan or a predecessor plan shall again be available under the Plan.

SECTION 6

OPTIONS

6.1. The grant of an "Option" under this Section 6 entitles the Participant to purchase shares of Stock at a price fixed at the time the Option is granted, or at a price determined under a method established at the time the Option is granted, subject to the terms of this Section 6. Options granted under this section may be either Incentive Stock Options or Non-Qualified Stock Options, and subject to Sections 11 and 16, shall not be exercisable for six months from date of grant, as determined in the discretion of the Committee. An "Incentive Stock Option" is an Option that is intended to satisfy the requirements applicable to an "incentive stock option" described in section 422(b) of the Code. A "Non-Qualified Stock Option" is an Option that is not intended to be an "incentive stock option" as that term is described in section 422(b) of the Code.

6.2. The Committee shall designate the Participants to whom Options are to be granted under this Section 6 and shall determine the number of shares of Stock to be subject to each such Option. To the extent that the aggregate fair market value of Stock with respect to which Incentive Stock Options are exercisable for the first time by any individual during any calendar year (under all plans of the

I-6

Company and all Related Companies) exceeds $100,000, such options shall be treated as Non-Qualified Stock Options, to the extent required by section 422 of the Code.

6.3. The determination and payment of the purchase price of a share of Stock under each Option granted under this section shall be subject to the following:

6.4. Except as otherwise expressly provided in the Plan, an Option granted under this Section 6 shall be exercisable as follows:

The terms and conditions relating to exercise of an Option shall be established by the Committee, and may include, without limitation, conditions relating to completion of a specified period of service, achievement of performance standards prior to exercise of the Option, or achievement of Stock ownership objectives by the Participant. No Option may be exercised by a Participant after the expiration date applicable to that Option.

6.5. The exercise period of any Option shall be determined by the Committee and shall not extend more than ten years after the Date of Grant.

6.6. In the event the Participant exercises an Option under this Plan or a predecessor plan of the Company or a Related Company and pays all or a portion of the purchase price in Common Stock, in the manner permitted by subsection 6.3, such Participant, pursuant to the exercise of Committee discretion at the time the Option is exercised or to the extent previously authorized by the Committee, may be issued a new Option to purchase additional shares of Stock equal to the number of shares of Stock surrendered to the Company in such payment. Such new Option shall have an exercise price equal to the Fair Market Value per share on the date such new Option is granted, shall first be exercisable six months from the date of grant of the new Option and shall have an expiration date on the same date as the expiration date of the original Option so exercised by payment of the purchase price in shares of Stock.

SECTION 7

RESTRICTED STOCK

7.1. Subject to the terms of this Section 7, Restricted Stock Awards under the Plan are grants of Stock to Participants, the vesting of which is subject to certain conditions established by the Committee, with some or all of those conditions relating to events (such as performance or continued employment) occurring after the date of grant, provided however that to the extent that vesting of a Restricted Stock Award is contingent on continued employment, the required employment period shall not generally be less than three years following the grant of the Award unless such grant is in substitution for an Award under this Plan or a predecessor plan of the Company or a Related Company.

I-7

7.2. The Committee shall designate the Participants to whom Restricted Stock is to be granted, and the number of shares of Stock that are subject to each such Award. In no event shall more than five million shares be granted under Sections 7, 8 and 9 of the Plan. The Award of shares under this Section 7 may, but need not, be made in conjunction with a cash-based incentive compensation program maintained by the Company, and may, but need not, be in lieu of cash otherwise awardable under such program.

7.3. Shares of Restricted Stock granted to Participants under the Plan shall be subject to the following terms and conditions:

SECTION 8

RESTRICTED STOCK UNITS